Ethereum, the second-largest cryptocurrency in the market, has continued to battle bearish winds alongside other top assets, including Bitcoin and Solana. According to our professional analyst, a short-term analysis of the Ethereum price chart indicates the altcoin is at risk of dropping below a major support level to the $1,400 mark. However, Ethereum Bears must push the price below a major resistance level around the $1,690 zone to validate the bearish thesis.

Meanwhile, we expect Ethereum bulls to defend the $1,545 support level. If that fails, the bears will take over, dragging the Ethereum price to the $1,400 support range. On the other hand, if the bulls defend the $1,690 zone, the bearish thesis will be invalidated, and Ethereum will likely begin an uptrend to the $1,800 range. In the higher timeframe, our analysts suggest Ethereum will hit a resistance wall around the $1,800 region and rebound to a higher resistance level around the $1,980 level. Several take profits and stop losses are resting there, with bears ready to snatch control from the bulls. If the bulls fail to defend this region, the bears could drag Ethereum’s price back to the $1,400 zone.

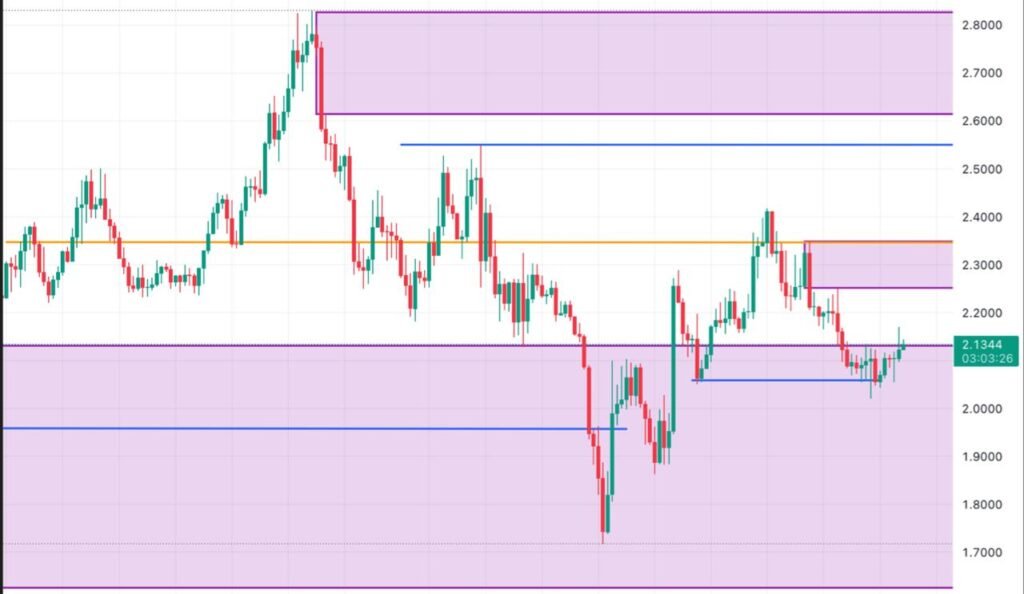

However, if bullish momentum persists, Ethereum could see an uptrend to the $2030-$2100 range, which confluences with a bearish order block, where the bears again have the potential to push Ethereum’s price to the $1,400 zone. According to CoinGecko, Ethereum is currently trading around the $1,650 level, indicating that the bulls still have their work cut out to prevent Ethereum bears from dragging the altcoin price below the key support level.